Get ready for the new alcohol duty rates and reliefs due on 1 August 2023

30 June 2023 - Inn Express

Since February 2019, the United Kingdom's alcohol duty has been maintained at a steady rate. However, this static state was disrupted this March, when the government unveiled plans for a pivotal duty reform set to commence on the 1st of August, 2023.

This progressive legislation aims to streamline alcohol duty rates across a wide spectrum of producers – encompassing beer, spirits, cider, both still and sparkling wines, as well as other fermented drinks. It calculates the tax based on the volume of pure alcohol present in each product. This simplifies the existing structure, consolidating the current 15 tax bands into a more manageable 8. Nonetheless, it's worth noting that this represents the most significant shakeup the UK alcohol sector has witnessed since 1975.

Aware of the considerable implications this will have on the wine industry, the government has implemented a transitional period to ease the transition. This adjustment window commences on the 1st of August, 2023, and concludes at the end of January, 2025. During this phase, the duty for both still and sparkling wines with alcohol content ranging from 11.5% to 14.5% should be calculated using an 'assumed' strength of 12.5% ABV, to simplify the process.

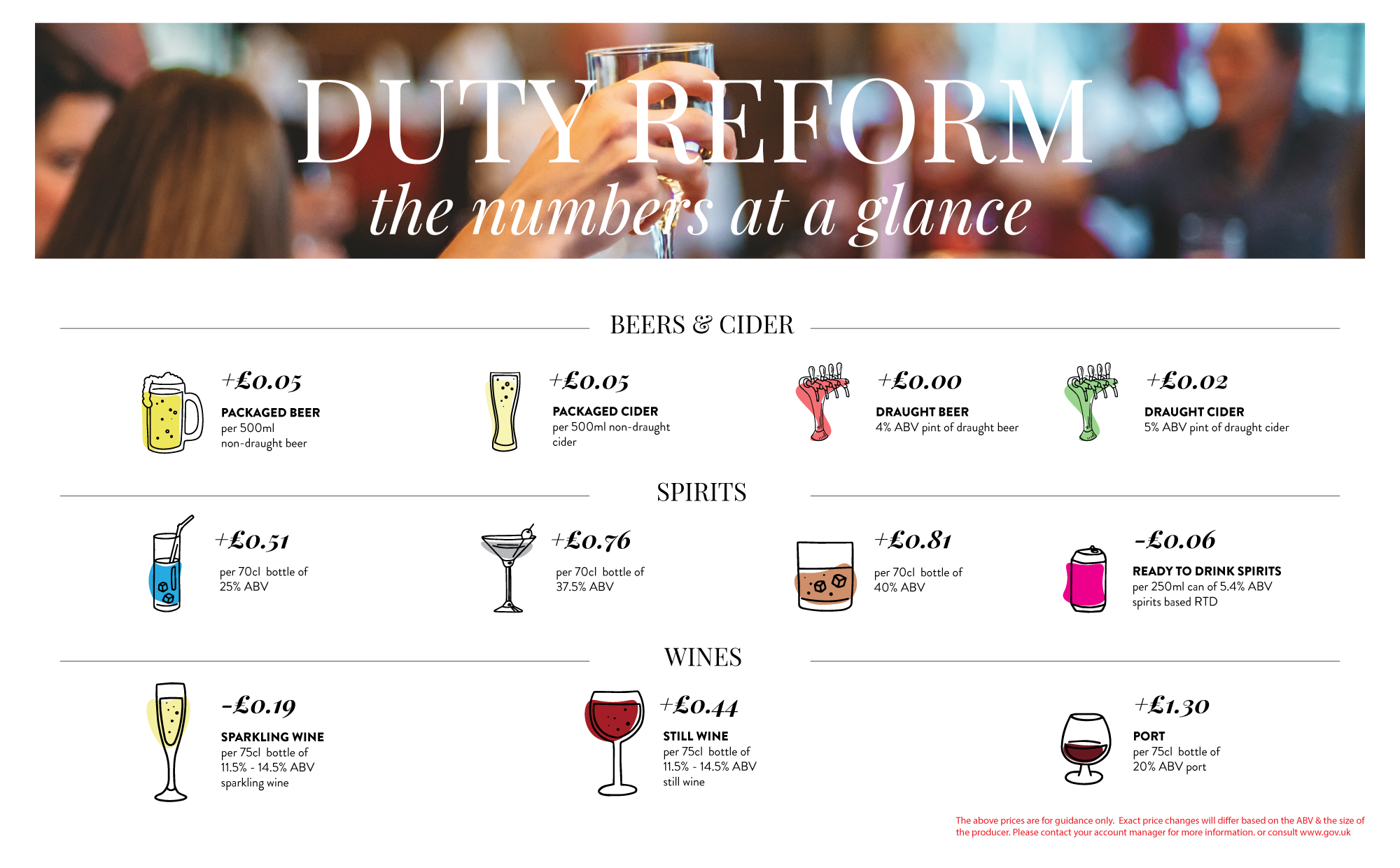

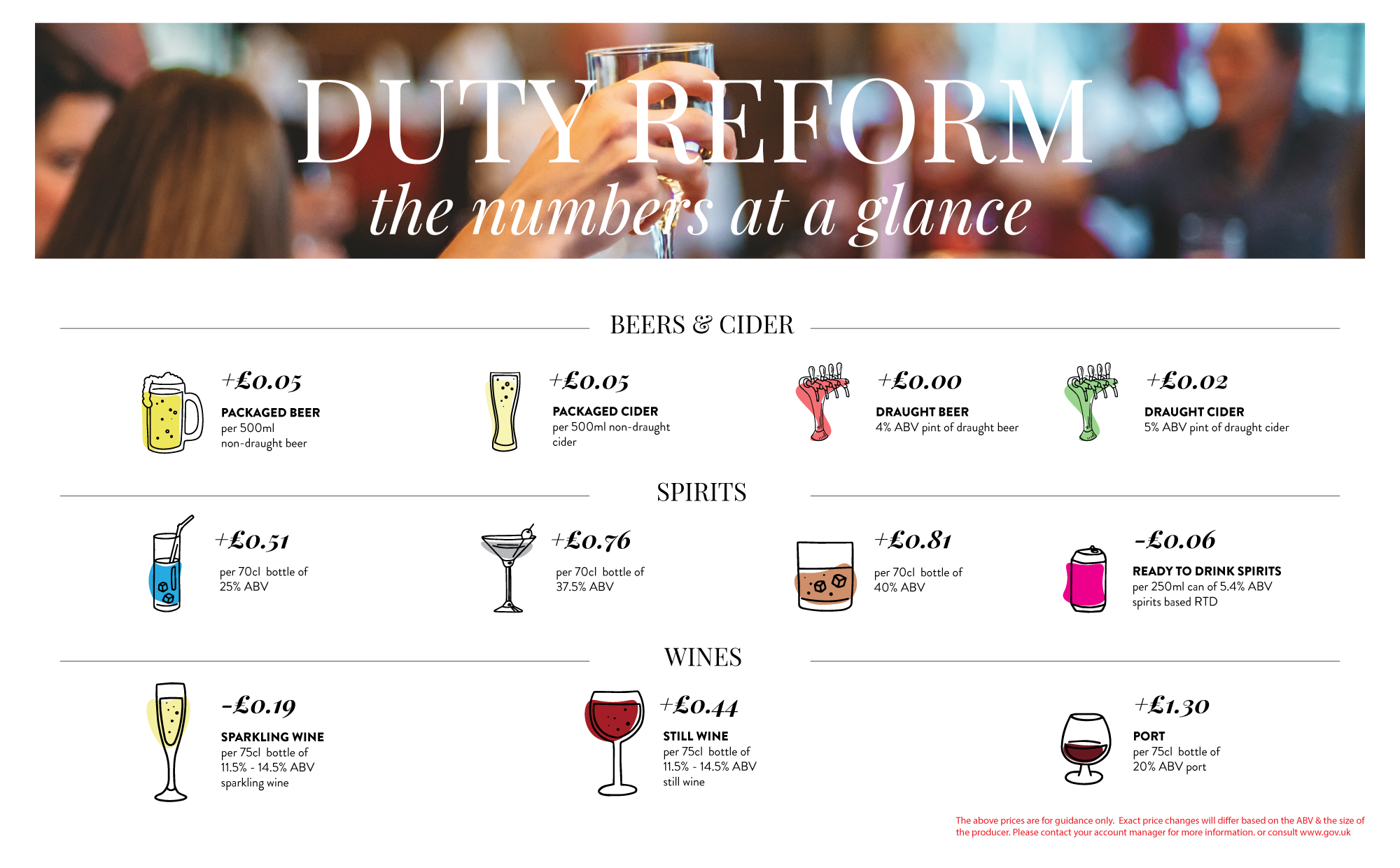

To help you understand the impact of the new structure, we’ve outlined the key changes below:

- All alcoholic products will now be measured using ‘Alcohol by Volume’ (ABV).

- Products such as Cider, Wine, and Made Wine were previously measured using Volume.

- All products will change their Duty Band from the 1st August 2023.

- Allocating the Duty Band will include classification, ‘ABV’ and ‘End Use’ (Draught)

- The impact of this change varies by category, with some key changes noted below:

- Draught Beer & Cider: Protected from duty increases by the 9.2% discount offered on items in 20ltr containers that are less than 8.5% and use a dispense system. This means that the duty on a 50ltr 4% lager will not change.

- Packaged Beer: The standard rate of duty on packaged beer 3.5% and above will increase by 10.1%. This will increase a bottle of 500ml non-draught laher by 5p.

- Spirits: The standard rate of duty for Spirits over 22% ABV is increasing by 10.1% in line with RPI. This will increase the price of a standard bottle of 40% Spirits by £0.81 per bottle. There are new bandings for products with less than 22% ABV and less than 3.5%, which will reduce duty vs current rates.

- Wine: Duty for Still & Sparkling wine will now be based on the % alcohol per litre and the duty harmonised (previously sparkling wine had a higher rate than still wine). This means the higher the ABV, the higher the duty. To help businesses adjust to the new legislation, wine between 11.5% and 14.5% will be treated as if it is 12.5% by volume until 2025. The duty on a 12% Still Wine will increase by £0.44 per 75cl. A 75cl bottle of 12% Champagne will see a £0.19 reduction.

In anticipation of the 1st August change, here are some strategies you might consider:

- Consider implementing the duty hike on the 1st of August and adjusting your wine lists or retail prices before the deadline.

- Increase your stock inventory of high-demand lines before 31st July 2023. This can help postpone the price increase until September, allowing you to revise your menus and retail offerings in due course.

- Based on the composition of your sales, you may decide to maintain current menu prices beyond the busy summer period. This would be feasible if savings on sparkling wines could counterbalance the duty increase on still wines.

- Modify your product selection before the 1st of August, adding more low-alcohol wines, beers, and spirits to your lists.

We are working with all brand owners to ensure they have provided the correct information, including any changes they make to their products, before 1st August 2023.

We have followed the guidelines provided to us by the Government and our supply partners; however, we reserve the right to change the duty element of the pricing should we find a system error at a later stage.

In the meantime, if you have any questions about this, please don't hesitate to reach out to your account manager in the first instance.